When you’re just getting started, it’s critical that one of your first steps is to create your nonprofit’s first budget to help you manage both your organization and your finances as it grows.

A budget combined with a fundraising plan can help you make sure there’s always money to pay for the things you need to operate your programs.

Without a budget, you can find yourself in deep water, fast, with more money going out than coming in.

Not a fun place to be.

It’s easy when you’re just starting out – and you’re super excited about the future – to operate on a lot of hope.

Now, hope is not a bad thing. But you need some practicality and planning to go with it.

Your budget will help you make sure the bills get paid, especially as you take on additional expenses.

Your budget will also help you get funding because you can show donors that you know exactly what it costs to deliver services.

If you want your new nonprofit to grow successfully and fulfill its mission, a budget is not optional. You must create and use one.

Don’t fall into the trap of “we don’t know how many people we’re going to serve, so we’ll just make it up as we go” or “we don’t have much money to operate, so we don’t need a budget.”

Yes, you still need a budget. Trust me, it will make your life easier and it shows you’re serious about your nonprofit and its future.

So, how do you create a budget? What goes into your first budget? And how do you get it done if you’re not a numbers person?

Creating your nonprofit’s first budget

For most brand-new nonprofits, creating your first budget means starting with a blank piece of paper (or a blank screen).

It can seem a little overwhelming, but it doesn’t have to be.

Here are 5 steps that will help you create your first budget for your new nonprofit.

1. Carve out time to do it. This is not a fast activity, so commit to taking the time to do it and do it right. Since your nonprofit is new, you don’t have historical numbers to look at and base your projections on. That means you have a lot of estimating to do for your nonprofit’s first budget. Mark off a couple of blocks of time on your calendar to research things like supplies, materials, and equipment online or call local vendors to find out what things cost. It’s best if you get 3 estimates for each line item on your budget so you know your estimate isn’t too low or too high. If you don’t leave yourself enough time to complete this part, your budget may not be realistic or accurate and that won’t serve you very well later when you’re depending on this tool to guide your financial decisions.

2. Decide on program activities for this year. It’s time to ask yourself some questions about the programs and services your new nonprofit will provide this year. What program(s) will you run this year? What supplies, equipment, facilities, and staff will you need to operate the program(s)? When your nonprofit is new, it’s easy to bite off more than you can chew initially. Be realistic about what you can successfully operate the first year, especially if you will need to raise the money for the program(s) (fundraising can be a bit slow at first).

3. Estimate expenses for all program activities. Once you have your program activities defined and a list of needs for the program, it’s time to get quotes and estimates for each line item you plan to include in your nonprofit’s first budget. As much as you can, contact vendors and potential providers to get real estimates for costs. For example, if your nonprofit is a food pantry and you want to add shelving, don’t guess how much those shelves will cost. Do some research to find out first what kind of shelves you need for commercial use (there’s a difference between the quality of shelving you can buy at local retailers for your home and shelves that are durable enough to handle daily use). Then get estimates from at least 3 vendors so you can see what the going price is. Put that number in your budget. Repeat this exercise for every line item in your nonprofit’s first budget. Again, don’t try to shorten this process by guessing.

4. Estimate revenue. Every budget has two parts: expenses and revenue. We’ve covered expenses, so it’s time to estimate revenue for your nonprofit’s first budget. Start by projecting any fee for service or program revenue, then get out your fundraising plan. You need to have a well-thought-out plan for generating the revenue you need to support your programs, not “we hope to raise the money.” Lay out each fundraising activity you plan for the year along with a conservative estimate of how much you think you can raise from each one. If you are too optimistic in estimating revenue and you don’t reach your goals, you’ll find yourself struggling to pay the bills later in the year.

5. Adjust until you get a $0 balance. Once you have your total revenue estimated, compare that amount to your total expenses. If revenue doesn’t cover expenses, you’ll need to adjust either revenue, expenses, or both until totals are equal. Again, be careful not to overestimate your revenue just to get a zero bottom line. Be sure you can actually raise the number you put in for fundraising.

Line items to include in your first budget

You may be wondering exactly what line items to include in your nonprofit’s first budget.

Good question.

Here are the categories you might include:

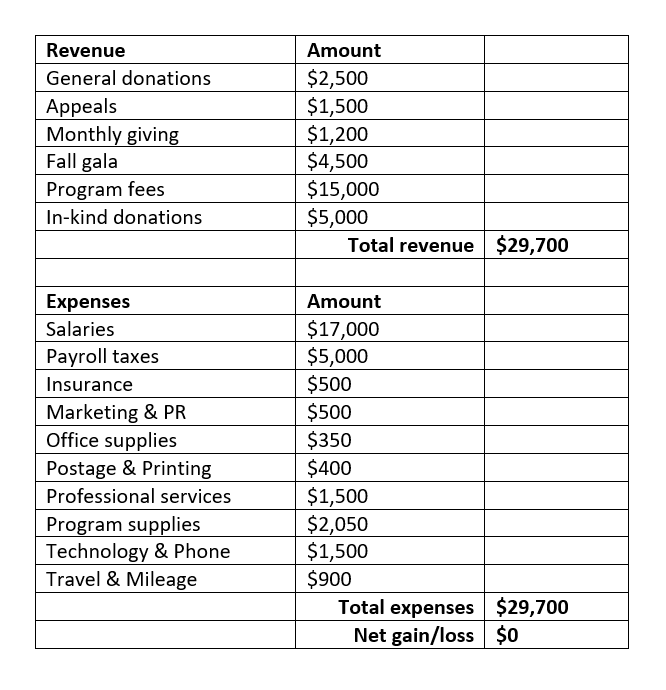

Revenue

- Program revenue (separate lines for each program or source of revenue)

- General donations

- Event revenue (separate lines for each event if you have multiple events)

- Appeal revenue (separate lines for each appeal)

- Grant revenue (but only if you’re REALLY confident you’ll get the money; otherwise, leave it at zero)

- Monthly giving

- Anything else that’s a significant source of revenue you want to track (churches, civic groups, corporate, patient donations, etc.)

- Miscellaneous revenue (interest income, etc.)

Expenses

Staff

- Payroll

- Benefits

- Payroll taxes

- Contract staff

Facilities

- Rent/mortgage

- Utilities (electricity, water)

- Pest control

- Maintenance

Program

- Equipment

- Supplies

- Materials

- Mileage (specifically related to conducting your program’s activities)

Administrative

- Office supplies

- Software (Quickbooks, donor tracking software, merchant account, etc.)

- Technology (website, network, etc.)

- Printing/postage

- Fundraising expenses

- Phone/internet

- Marketing expenses (graphic design, advertising)

- Professional development (training and conferences)

- Memberships, affiliations (dues & subscriptions)

- Travel/mileage/parking

- Insurance (liability for the facility, errors and omissions for Board, worker’s comp, etc.)

- Licenses & permits (charitable registration fee)

- Miscellaneous (bank fees, etc.)

- Volunteer appreciation

Here’s a sample startup budget for a new nonprofit:

Tips

As you put your budget together, here are some tips that can help you.

Get smart about budgeting

You’re a smart cookie. After all, you’re here reading this!

To be even smarter and make your life and the budgeting process easier next year, there are two things you can do.

1. Start early. Start earlier than you think you need to because more time makes everything easier, especially with your nonprofit’s first budget!

2. Carefully track your numbers this year, and next year’s budget will be easier to create. That means diligently tracking and recording expenses and revenue, plus program numbers (like number of people helped, number of dogs adopted, etc.). Those details will come in super handy when you start projecting expenses for next year.

3. Use accounting software to help you manage your finances. Even if your nonprofit is just getting started, it’s not too soon to get into Quickbooks or another accounting software that can help you track and analyze all your income and spending. Here’s a list from Forbes to get you started on your research into which tool will work for you.

The Bottom Line

Your nonprofit’s first budget is a critical tool for both planning purposes and managing finances as the organization grows.

Spend the time to put some thought into creating a budget for your new nonprofit.

It will serve you well as you run your programs, grow your organization, and make a difference in the world.

Thank you for the great information! Excellent writing!

Quickbooks tool hub makes you feel helped in this case. This is the best accounting tool that is used to get the best online accounting tools at a single place. This is by the trust of the quickbooks.

Very nice articles which will help the newcomers a lot in accounting. The one app that can also help you a lot in learning about it is Quickbooks.

You can learn about anything related to QuickBooks here.https://toolhub.me/

Thanks so much for this article. Very useful and applicable information.

You’re welcome!

Good evening,

What are you referring to with appeal revenue?

Appeal revenue means the money coming in from appeals, fundraising letters, and anytime you’ve asked your donors for money.

I am reading a blog on this website for the first time and I would like to tell you that the quality of the content is up to the mark. It is very well written. Thank you so much for writing this blog and I will surely read all the blogs from now on.

Thank you once again for another excellent article.I have searched my query everywhere but I didn’t found any solution but finally I got your article, which is easy to understand, Thanks.

i am very impressed with the lessons. I am planning to be fully part of the program.

Thank you for providing such a piece of useful information.

You can use QuickBooks as your accounting software for a small- to medium-sized business to help organize your finances.

This is just what I needed to apply for our first grant!! Fantastic! Thanks a bunch, Sandy!!

Thank you for posting.

Thank you for commenting!

Thanks For sharing for article

Hey this came in handy. Just started my non profit this year in Texas. So much work to do. I am now 501c3 status with IRS. Helping Minors here. If you read this and want to help. Check me out on Fundly under the campaign “MINORTHINGS” All one word. Thanks and good luck to you all!!