Online fundraising allows your nonprofit to earn donations from a wide audience, growing your network and raising more for your cause. Today, most modern nonprofits engage in at least limited online fundraising to engage supporters even while following social distancing guidelines. Which means you’re going to need to register to fundraise online.

As a nonprofit leader, you are likely familiar with donation solicitation laws. In order to solicit donations, you’ll need to follow your state’s filing requirements and properly register before collecting donations. However, online fundraisers that include out of state donors complicate this process.

To help your nonprofit’s leadership understand and comply with online fundraising guidelines, this article will provide a crash course on the basics of maintaining legal compliance while fundraising online. This guide will provide an introduction to the basics of online fundraising legal considerations, then walk through potential application routes and more specific legal requirements for your nonprofit to consider:

- What is online fundraising?

- Applying to Fundraise Online

- Legal Requirements

This process can become confusing, so keep in mind that your nonprofit doesn’t need to navigate these legal channels alone. Nonprofit legal consultants have helped thousands of nonprofits like yours successfully (and legally) fundraise online.

What is online fundraising?

For anyone experienced in nonprofit fundraising, this may seem like an obvious question. However, given the specificity of the law, it is necessary to understand what counts as online donation solicitations and how crossing state lines can impact your online fundraisers.

According to 360MatchPro’s fundraising statistics report, online fundraising is only growing in popularity as 63% of donors in the U.S. and Canada report preferring to give online. However, the fundraising compliance landscape still relies on old rules, despite the popularity of new digital methods.

This means all state and federal regulations that apply to donating through traditional means also apply to online fundraising unless stated otherwise.

For most states, soliciting donations refers to any ask made by your organization for a charitable gift as well as selling goods or services in exchange for money that will benefit a charitable cause. This also technically applies to online donations, and like with most donation solicitations, your nonprofit will need to be registered in the state your donors reside in. This process is called charitable solicitation registration or fundraising registration.

The exact language used in laws concerning online fundraising can sometimes be vague in order to encompass a wide range of nonprofit organizations and their unique practices.

In general, offline fundraising activities refer to phone calls, mailing solicitations, events, and other similar donation generating practices. Your nonprofit will almost certainly need to be registered in the state you perform these activities in.

Online fundraising applies if you receive “substantial” donations through the internet from residents of a state on a “repeated or ongoing basis.” What exactly constitutes a substantial donation or how many donations makes fundraising ongoing is up for debate. However, your nonprofit’s leadership would likely prefer to avoid having that debate with your state’s charity bureau. Thus, you should keep a careful eye on your state’s specific legal requirements for online fundraising.

Applying to Fundraise Online

Due to the confusion surrounding online fundraising, there are several myths and misconceptions about nonprofit registration that new professionals can get caught up in. To help cut through the confusion, this section will breakdown three core requirements your nonprofit should be aware of before launching an online fundraiser.

Legal Requirements

In case you need a little extra motivation to file your annual tax return, the IRS has set up a system of financial penalties for organizations that fail to complete their forms on time.

This guide outlines the immediate consequences you’ll need to consider for if you miss the Form 990 deadline:

- For every day that you fail to file: Your organization may be responsible for financial penalties that increase each day you do not file. For smaller organizations, these fees can be up to $20 per day for a total of $10,000 or 5% of your overall receipts.

- For three consecutive years of not filing: Your organization can lose its 501(c)(3) status, and a result, its federal tax exemption. Then, you’ll be on the hook for applicable taxes and fees until you complete the application process and pay the filing cost again ($600 for the 1023 or $275 for the 1023-EZ).

But don’t worry—if you find yourself approaching your filing deadline (the 15th day of the 5th month after the close of your fiscal year), you can always apply for a free six month extension. Just file Form 8868 prior to your deadline instead to give yourself some extra time.

Charitable Solicitation Registration

Over forty states require nonprofit organizations to complete their charitable solicitation registration process before soliciting donations in their state. For many of these states, this applies to both traditional fundraising and online fundraising, meaning your nonprofit will likely need to register in every state you intend to solicit donations in.

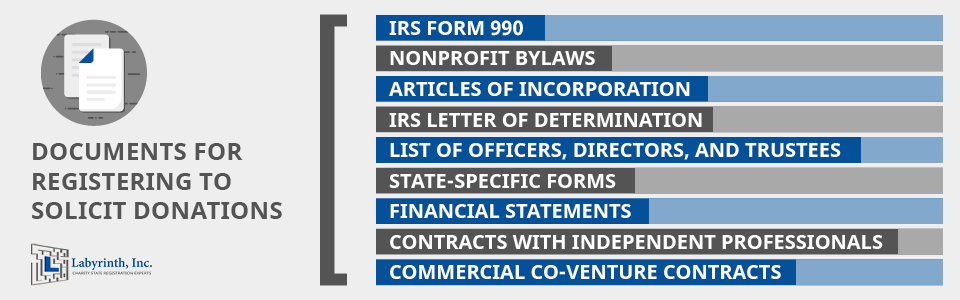

Few states have identical charitable solicitation registration processes, which means you will need to look up the exact requirements of each state and prepare unique applications. Fortunately, many of these states require the same documents, meaning a well organized nonprofit should have most of the materials already on hand after registering in one state.

Here are the most common forms requested by states to apply to solicit donations:

- IRS Form 990

- Nonprofit Bylaws

- Articles of Incorporation

- IRS Letter of Determination

- List of Officers, Directors, and Trustees

- State-Specific Forms

- Financial Statements

- Contracts with Independent Professionals

- Commercial Co-Venture Contracts

Keep in mind that a state’s charitable solicitation registration process is subject to change without notice. As you complete your application, stay updated on your state’s requirements, and make sure to double check your assembled forms against your state’s requirements a final time before submitting your application.

Gambling or Games of Chance Licenses

Certain types of popular fundraising activities such as raffles and auctions require your nonprofit to apply for a gambling or games of chance license. As with most nonprofit legal requirements, the specifications will vary between states and even municipalities, with some allowing nonprofits to obtain special licenses for a limited period of time or even just one event while others require nonprofits to apply for a license like any other organization.

Choose your fundraiser carefully, as more activities require licenses than you might first assume. For example, the IRS has special rules just for bingo fundraisers. You’ll also need to be conscious of whether or not your supporters can claim their contributions as tax deductible and communicate this to them thoroughly so they can properly fill out their tax returns.

Email Fundraising Laws

Email is a popular nonprofit fundraising tool and for good reason. Its low investment cost and customizability allow nonprofits to reach a wide range of supporters when soliciting donations. However, there are also unique legal requirements concerning email.

Labyrinth’s guide to fundraising legal requirements discusses three cornerstone pieces of digital privacy legislation that nonprofits should be aware of:

- The CAN-SPAM Act. The CAN-SPAM act allows nonprofits to only email subscribers they can verify have opted in to receive their emails. This takes two forms: express and implied permission. Express permission is when a supporter explicitly gives your nonprofit permission to communicate with them via email. Implied permission occurs when you collect email addresses as part of another transaction. You will need to inform donors about their agreement to future emails and provide an opt-out option for both express and implied permission.

- The General Data Protection Regulations (GDPR). The GDPR protects EU citizens’ data. If your nonprofit has any European supporters, you’ll need to take measures on your website and in your emails to follow the GDPR’s guidelines.

- The California Consumer Privacy Act (CCPA). Given California’s population, chances are that your nonprofit will need to apply to solicit donations in California, meaning you’ll also need to be conscious of the CCPA. This 2018 law protects California residents’ data, imposing limitations on how for-profit businesses can collect and use personal data. Nonprofits are technically exempt from this law, but if you work with third-party vendors that aren’t, you’ll need to follow the CCPA’s requirements.

In general, your nonprofit’s leadership and fundraising directors should take care to familiarize themselves on data protection policies to avoid infringing on their supporters’ privacy. If your team is unsure if your practices comply with these protections, consider seeking out a nonprofit legal consultant to ask specific questions about your email strategies.

The Bottom Line

Online fundraising allows your nonprofit to expand your supporter base across states and even across countries. However, you’ll need to research the necessary steps to fundraise legally before soliciting donations. Familiarize yourself with your state’s online fundraising policies and consider your compliance options as your nonprofit grows and expands its operations outside of your home state.

About the Author

Dr. Stephen Urich is the CEO of Labyrinth, Inc., an organization that assists charitable organizations with all aspects of charity state registration and compliance. He is also a Certified Public Accountant and specializes in nonprofit accounting. He has been working in the nonprofit sector for 25 years.

Dr. Stephen Urich is the CEO of Labyrinth, Inc., an organization that assists charitable organizations with all aspects of charity state registration and compliance. He is also a Certified Public Accountant and specializes in nonprofit accounting. He has been working in the nonprofit sector for 25 years.

Leave A Comment