When set up right, your nonprofit accounting system will help you manage your nonprofit and streamline processes like budgeting, projecting cash flow, and even hiring.

The problem is that if you’re like most, you haven’t paid a lot of attention to your accounting system.

Most people who start or lead nonprofits aren’t numbers people.

In fact, they’d rather do most anything else than manage numbers. Maybe that’s you!

But you must learn to manage numbers if you want to grow your nonprofit, fulfill your mission, and make a big difference in the world.

Plus, systems can seem unimportant when there are 100 other things to do!

The best time to implement and start using a good nonprofit accounting system is from the beginning.

It should be part of your organization’s internal culture.

If you don’t yet have good accounting systems in place, NOW is the time to correct that.

We’ve worked with nonprofits that ignored their Quickbooks and just did the minimum to get by.

Not only is it a mess to get accurate financial reports, you can’t get the data you need for grants which can wipe out your chances of getting grant funding.

Plus, they have no process for handing expense reimbursements or reconciling bank statements. Again, big mess.

So, it’s best to take the time to get your financial house in order.

Starting or fixing your accounting system BEFORE you have a problem is just smart planning.

Because believe me, without a good nonprofit accounting system in place, you WILL run into problems later. I promise you will.

What a Nonprofit Accounting System IS

What do I mean by “nonprofit accounting system?”

I mean two things: One is the actual software you use like Quickbooks or Aplos that is meant for nonprofit use, and two is the actual processes you use to manage your accounting.

It’s best to get both in place as soon as possible.

Even if you have a tiny nonprofit and everything is recorded neatly on spreadsheets, you need more.

Maybe not today, maybe not tomorrow, but you will need more.

And going back to retroactively enter data is a huge time-consuming headache.

We’ve tried to help small nonprofits with messed-up accounting systems raise money, and it’s extremely difficult. We always have to hit the “pause” button while we clean up the accounting mess.

It’s best to set things up right and follow nonprofit Accounting best practices to keep your system working well.

So, let’s talk about what it takes to put a good nonprofit accounting system in place, starting with some common misconceptions and fears related to accounting.

Myths About The Nonprofit Accounting System

MYTH: I already have a Donor Management System, so I don’t need an accounting system.

FACT: Donor Management is NOT the same as Accounting. While Donor Management is crucial, it’s crucial for different reasons. The sole purpose of a Donor Management system is to track donors, track your communication with donors, and track donation information. Accounting on the other hand, tracks how those donation dollars are allocated and spent. Your Donor Management system helps you identify potential major donors and spot trends in giving. Your Accounting system helps you manage cash flow and prepare your 990.

MYTH: I don’t need an accounting program to tell me how much money I have. I can look at our bank account anytime and know exactly where we stand.

FACT: A properly managed nonprofit accounting system tells you much more than where you are today or this month. It will give you a historical view of your income and expenses and tell you exactly where your money is going each month. You can run reports and see quickly the key pieces you need to monitor to assess the nonprofit’s financial health. Financial management is about much more than just dollars in the bank. It’s about spending patterns, revenue projections, and the likelihood of reaching financial goals. These are all things you should be carefully monitoring as your nonprofit grows.

MYTH: Nobody has time to enter data into an Accounting program.

FACT: Most Donor Management Systems automatically integrate with the most-used accounting programs, including Quickbooks. This means that when someone donates online, that information automatically transfers from your Donor Management software to your accounting software. There’s no need for duplication of effort with the automation that’s available through most programs. Plus, once you set it up and map the fields (i.e. how they “talk” to each other), the information will always be coded and categorized correctly and not subject to human error. For information that does need to be entered, Quickbooks remembers how you coded items last month and will offer those as suggestions for any new entries, making data entry pretty fast, especially if you spend money with the same vendors each month.

MYTH: We don’t have much money right now, and we just have a few donors. There’s nothing to really manage and definitely not enough to justify spending money on Accounting software.

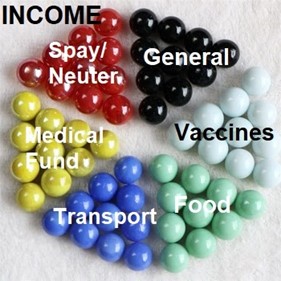

FACT: This is EXACTLY the time when you need Accounting software. Here’s a visual example for you.

Imagine you have a pile of marbles, and they need to be sorted out by color.

Is it easier to sort them now?

Or is it easier to wait until you have more marbles?

It’s easier with fewer marbles right?

Let’s take it a step further.

Let’s say you run an animal shelter. And everyone who has donated a red marble says they want that marble to be used for spay/neuter surgeries.

Without an Accounting system, how will you know how many red marbles there are?

You can’t use those red marbles to buy food or supplies because they have been earmarked for spay/neuter.

To make matters more complicated, some people donated green marbles to pay for dog and cat food.

How in the world are you ever going to keep track of all this?

With a properly functioning Accounting system, that’s how.

Different categories can be set up in the software to track exactly how much you’ve designated for specific purposes and to fulfill your obligation to the donors who wanted their dollars to go to a specific cause.

So, let’s compare again:

With an accounting system:

Without an accounting system:

The same concept applies to expenses.

You want, and actually need, to know exactly what you’re spending your money on. Past and present patterns help you plan for the future!

Can you afford to hire someone now or do you need to wait 3 months?

Can you afford to rent that space next month based on cash flow projections?

What about that old horrible computer, can you afford to replace it by year end?

Most importantly, are you spending wisely so that you can make the most impact on the most lives?

Using your Accounting System Smartly

The categories and sub-categories in your Accounting system should give you fast and accurate information to make important decisions without jeopardizing your financial stability.

The categories and sub-categories in your Accounting system should give you fast and accurate information to make important decisions without jeopardizing your financial stability.

As long as they’re set up right and properly maintained, they’re super helpful.

If not? Well, your tool won’t exactly do its job.

If you have multiple people entering data and they’re categorizing stuff all willy-nilly, that’s where the mess starts. You’ll wind up with duplicate categories, mislabeled expenses, and more — none of which is fun to clean up. And if you have to hire someone to clean up your mess, that can get really costly.

So, set it up right, and use it right from the beginning.

Then, you can use reports from your Accounting software to manage your nonprofit and see things you might not notice otherwise.

Maybe you’re spending a little too much money on office supplies and not enough on your programs. A simple report with a pie chart can easily show you that.

Maybe you’re spending significantly more this year compared to last year without a significant increase in the number of program participants. A report showing comparisons can help you see this increase.

The only way to learn and to grow your organization is to understand where you’re spending, where you need more, and where you need to cut back.

Your Accounting system should be your # 1 tool in managing your nonprofit’s finances and keeping it financially healthy.

Applying for Financial Help

If you are in a position to apply for a grant, apply for a business credit card, or even apply for a loan or line of credit, you will NEED to have comprehensive data to present.

Lenders and grantors want to see a snapshot of your finances to get a sense of how well your nonprofit is doing.

They will want to know that you’ll be responsible with the funds they offer you and that you won’t be closed in, say, 6 months.

And more than anything, they’ll want to know that you truly need the funds you’re asking for.

They’ll discern all that from the financial statements and reports you provide them.

When your Accounting software is set up right, this should be an easy report or two.

Filling Out Form 990 or Other Government Reports

Having an organized Accounting system can make your tax filing a breeze.

You no longer have to dread the IRS Form 990 because with just a few clicks, you’ll generate all the reports you need.

Print, sign, send. Done.

Who Should Do Your Bookkeeping

One really important piece of your nonprofit accounting system is identifying who will do the day-to-day data entry and who will manage the whole system.

One really important piece of your nonprofit accounting system is identifying who will do the day-to-day data entry and who will manage the whole system.

When your nonprofit is new, it’s tempting to use the cousin, friend, neighbor, or in-law that does “bookkeeping.”

And many of those people are willing to volunteer their time to help you out, which saves money!

While this may seem like an ideal situation, proceed with caution.

You need a qualified bookkeeper who understands the software system you’ve chosen, who understands the basic principles of nonprofit accounting, and who can keep your system current — meaning, they have the time to spend keeping everything entered.

Volunteers can be awesome, but with no skin in the game, they can get behind or take shortcuts just to get the job done (I’ve seen it happen).

It might be better, since your Accounting is critically important, to spend the money on a paid contractor to tend to your books.

As a nonprofit organization, full transparency is required of you and it’s crucial to have a clean, well-kept set of books.

On top of the day-to-day bookkeeping needs, you should also work with a Certified Professional Accountant (CPA) to review your financials and do your tax filings (a separate person than the one doing your bookkeeping). There are a few reasons for this.

- A professional CPA will take full responsibility if anything in your filings is inaccurate.

- It’s always a good idea to have more than one set of eyes on your books and your finances.

- CPAs keep up-to-date on filing requirements, deadlines, and tax changes that may affect you.

- If you’re ever subjected to an audit, the CPA will know how to answer any questions or inquiries that arise.

Set It Up Right From the Beginning

Trust me, it’s a PAIN to have to clean up a Quickbooks file!

So set up your Chart of Accounts right from the get-go.

That means you need to think about the different ways you’ll both generate and spend money.

And customize your accounts so they make sense for YOUR nonprofit.

One size does NOT fit all here.

We had a client that worked with an accountant to set up their chart of accounts and it was clearly copied from some standardized list.

The list contained several accounts that were business-oriented that had nothing to do with the nonprofit or its operation.

There were also lots of duplications of accounts that made it difficult to get accurate information from the system, requiring hours of manual data manipulation to get what was needed.

The worst part was, at the end of the day, we still didn’t trust that the numbers we had crunched were accurate because of how they were entered initially.

So, take the time to plan out what you’ll need from your system and set it up right from the beginning so YOU don’t have to clean up a mess later!

Sharing Isn’t Always Caring

Your nonprofit should have its own bank account without exceptions.

That means you should never mix or commingle yours or anyone’s personal funds with the nonprofit’s funds.

Not only does this create a very gray area in terms of finances, it’s also illegal in some states.

The same rule applies to credit cards and loans.

As a general guide, keep everything that belongs to the nonprofit completely separate from things that belong to you — money, equipment, tools, credit cards, and anything else you can think of.

Handling Restricted Funds Correctly

Getting donations is one thing. Handling them correctly is another.

And depending on how you ask and the donor’s intent in giving, you may have restricted funds on your hands that need to be carefully managed to prevent your nonprofit from getting in trouble with the donor or the government.

Any donation given with the intent that it be used for something specific needs to be carefully recorded in your Accounting software so you can be sure the money is spent appropriately.

It’s important to track, manage, and spend restricted funds carefully and purposefully so you can report back to the donor exactly what happened to their donation.

Here in the U.S., the IRS is serious about restricted funds. Improper use can result in severe penalties or even loss of your tax exempt status. Boards can be sued by donors for misuse of such funds.

And maybe worst of all, your reputation and future fundraising potential can be destroyed by mishandling donations.

So, take this one seriously. Figure out how to track restricted funds in your system and do it.

Monthly Monitoring

Every month, you and your Board should be reviewing the financials from the previous month to see how the nonprofit did and to decide if there are any adjustments you need to make to spending or fundraising for the coming months.

Specifically, you should be monitoring:

- Organizational profit/loss to see if you stuck to your budget or had a surplus or deficit for the month.

- Month vs Year-To-Date numbers to see if your monthly income and expenses were on track and if you’re on track year-to-date.

- Cash in the bank to see if you have enough money to pay upcoming bills.

- Debt to see where you stand with anything you owe.

- Next 90 days to see what’s coming up and if you’re ready financially.

Depending on your situation, there may be other things that you need to monitor each month, too.

If you don’t monitor your nonprofit’s financial health each month, it will be easy for things to get real bad real fast. Then, you’ll find yourself facing some very difficult decisions about which programs to scale back and who gets laid off first.

Annual Operating Budget

One HUGE part of any good nonprofit accounting system is a detailed annual budget that’s written and tracked.

Let’s be honest here — without a budget, you’re operating on hope that things will work out.

So take the time to create an operating budget for your nonprofit.

Even if you’re busy and don’t have time. Even if you don’t have a lot of money coming in. Even if you’re not a numbers person.

Take the time to create an operating budget so you can better manage your growing nonprofit.

Bonus points if you enter it into your Accounting software and let the system track your progress for you!

Documenting Processes

We have a saying that if it’s not in writing, it’s not real.

That means that any process that isn’t documented isn’t a real process.

It may seem silly, especially if your nonprofit is brand new or tiny, to write down how you do things.

But you won’t be a new or tiny nonprofit forever.

And it’s much easier to train new hires or new volunteers if there’s a documented system in place.

So, whatever decisions you make about how you’ll do things, write them down somewhere so that it becomes part of your nonprofit’s operation.

Count Your Eggs Before They Hatch

Developing and organizing a nonprofit accounting system well before you think you need it is one time when we recommend putting the cart before the horse.

Any successful nonprofit starts with planning, planning, planning, and more planning.

And while you may not have gotten into this to deal with numbers and manage money, it’s part of the job.

Taking care of this task now will actually free up your time so that you can focus on what you WANT to do: Change Lives.

Which accounting software and which donor software do you recommend for new nonprofits? Ant specifics for nonprofits seeking to do a land trust or capital campaign to purchase land? Thank you!!

Sherilyn, we’re a fan of Quickbooks for accounting simply because it’s easy to find someone who can help you if you need it. For donor tracking software, check out Little Green Light, Bloomerang, and Kindful.

Hello Sandy,

Great information on the blog post. I have a question about the comment of using QB for non-profits. Can QB run a Statement of Financial Position by fund (or by the entire organization) and be balanced within that fund for its assets, liabilities, and total fund equity?

Thanks

We’re not Quickbooks experts, but I know that any system is only as good as the data entered. If you set it up to track money by fund, you will certainly be able to get reports by fund. Most nonprofits don’t do fund accounting because it’s so time consuming and can get into minute details. For the answer to your question, I will point you to the Quickbooks page for more info. https://quickbooks.intuit.com/industry/non-profits/

Thank you Sandy! Have you had much experience with Zipbooks? Someone had suggested that as they are free and a little easier to train on than Quickbooks since Quickbooks is more complicated. Thoughts? We are a 12 year old community garden that is 100% volunteer led. We are working on establishing our own nonprofit (we are currently working on our articles of incorp and bylaws). Most community gardens find a fiduciary sponsor and stick with that, but we are transitioning away from that to establish our own at this point in order to raise money and purchase the land. We want to keep our garden going (currently private property) for future generations. Once the capital campaign is over, we have limited income and expenses and so do not anticipate paying a lot for a bookkeeper or for software. Thoughts? Thank you for your time! 🙂

I haven’t heard of it. The thing that makes me nervous about tools like that is getting support. How many accountants will know anything about it or be able to help you get your 990 done? You won’t have that problem with QuickBooks. Sometimes free isn’t all that great, you know?

BTW, Thank you so much Sandy for your response. SUPER helpful!!

What accounting software do you recommend for my startup? We will be large, $8 mil per year with 7 programs.

Quickbooks is probably the best tool. It’s easy to find someone to help you when you need it.

Which quickbooks software is better? Desktop ?

It really depends on you and your needs. We like Quickbooks Online so you can use it from anywhere and get remote accounting support.