One of the most critical yet most neglected parts of a successful grant is the budget.

And hey, I get it. Not everyone is a ‘numbers’ person.

But here’s the truth: your grant must explain your request in both words and numbers.

In other words, your grant budget must paint the financial picture of your request.

What is a grant budget?

To be sure we’re on the same page, the “grant budget” is NOT your organizational budget. The purpose of the grant budget is to:

To be sure we’re on the same page, the “grant budget” is NOT your organizational budget. The purpose of the grant budget is to:

- Detail the costs of the program or project you’re proposing.

- Show the funder exactly what their money will pay for.

- List other sources of income for costs not covered by the grant being requested.

Ok, now that we’re clear about what it is, let’s look at how you create it.

Create a grant budget

1. Pick a Tool to Use – The first thing you’ll need to figure out is which tool the funder wants you to use. Check to see if they ask for a specific format or if they provide a template. If not, you can choose the format you want and create it however you see fit. I like using Excel – more about that in #6.

At this point in the budget preparation process, it’s a good time to figure out whether the funder wants you to provide budget information pertaining to the grant you’re asking for only OR the program or project you’re seeking funds for.

Let’s say you sift through the funder’s instructions and guidelines, but they don’t tell you what you need to do (and this happens sometimes).

What do you do then?

When this happens, try to contact the funder to get clarification about what to do. If you can’t get in touch with them, use the program/project budget.

Why? Because funders appreciate transparency and seeing the big picture and your program/project budget should give them enough information to understand what you’re trying to do.

2. Include Both Expenses and Revenue – Your grant budget should contain two sections: one that outlines your expenses and the other that shows your revenue (i.e. where the money will come from to pay for your program or project and how much each revenue source will generate).

I think we can all agree on why funders want to see the expenses…because they want to know how much your program or project will cost. But why do they care about where the other money will come from to pay for things?

Funders like knowing you’re not solely relying on their grant. They value investing in programs and projects that bring other resources to the table – like other grants, donations, and even volunteer service. Plus, showing them that you have secured some or most of the needed funds gives your program or project credibility because this means there are other people or organizations willing to invest in your nonprofit.

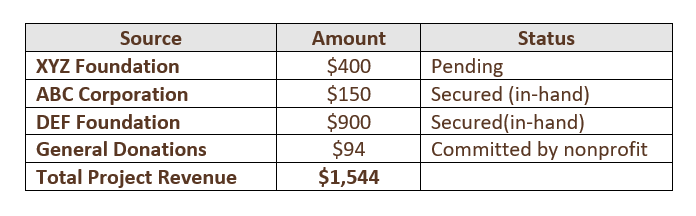

Here’s an example of how to show your revenue in your grant budget.

Revenue

By the way, funders providing you with their own budget tool don’t use the same one as the next funder. Every single funder is different. Sometimes, they only want to see the expenses. Sometimes, they may ask for both expenses and revenue. When you’re prepared with both, it’s easy to give each funder what they want.

3. Categorize your costs in a way that makes sense – There’s no rule that says how many lines or how few lines you need in a budget when you create it yourself. Your goal is to illustrate to the funder what it takes to successfully operate your program or complete your project.

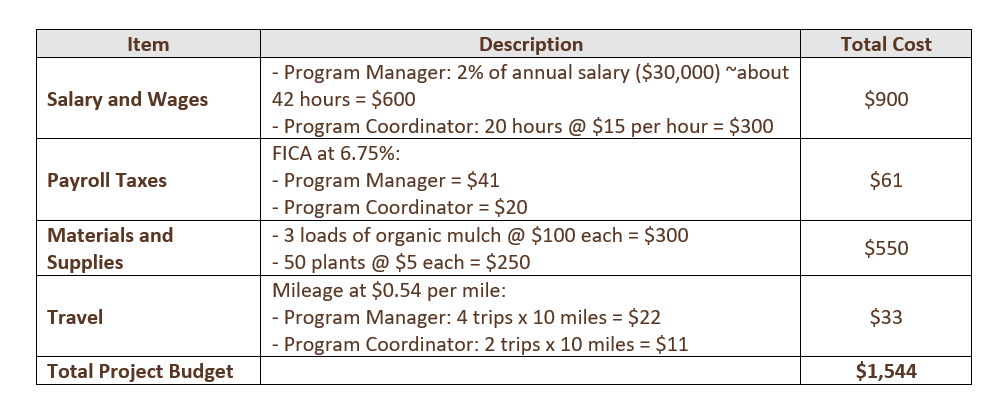

As you’re thinking through all of this, try grouping items into broad categories like Salary/Wages, Travel, Equipment, Materials and Supplies, etc. Then, assign dollar amounts to these – being sure to provide descriptions of how you arrived at your dollar amounts. Here’s a good format to use:

Before you know it, you’re on your way to creating a well-thought out, detailed budget that tells a story.

Speaking of telling a story….

4. Make sure costs tie in with your narratives – Someone should be able to look at your budget and understand what you’re proposing to do, even if they haven’t read your program or project description yet.

Unfortunately, a couple of the biggest mistakes people make when putting together a budget is leaving out things they discussed in their narratives and not making their budget match what they proposed in their narratives.

Here’s a tip to avoid doing that. Once you’ve pulled together your budget, take a step back and ask yourself, “Does this budget tell the same story as my narratives?” In other words, do the words and numbers match? To check, read through your narratives. Every time you mention something that costs money, stop and double-check that it’s in your budget.

5. Use real numbers – It’s critical that you base your budgeted expenses on the true costs of things. Please don’t pull numbers out of thin air!

Of course, getting dollar amounts for employee or mileage costs should be easy because your nonprofit should have that information or be able to project it. When it comes to other costs – like materials and supplies, for instance – you’ll need to do your research and find these on your own. A few good places to do this are:

- Stores – Need to buy 10 shovels for a project? Check out your local hardware retailer and see what their price is for the ones you want to buy.

- Online pricing – With technology at our fingertips, jumping online and finding a price can be really fast…just don’t forget shipping costs, if they apply. You’ll need to include these in your budgeted cost.

- Quotes from vendors – Maybe you’re replacing some flooring in an animal shelter or excavating some property to install a community garden. Getting a quote for what you need, especially when it’s a specialty project or service, takes the guesswork out of how much it’ll cost.

6. Make sure your numbers add up – This one seems obvious, right? But I can’t tell you how many times I’ve reviewed grant budgets and the costs simply didn’t add up to the total grant amount being sought out, total of costs in a category, or total program or project budget amount listed.

And you better believe funders whip out their calculators and check your math!

If you’re using a funder’s form, do yourself a favor and triple check your numbers. It only takes a minute and can be the difference in getting a grant or not. When creating a budget from scratch, I like to use Excel because I can use formulas and make them do the calculating for me. (Plus, I can format things easier.) If you need help with Excel, check out local trainings or simply Google “Excel tips” and you’ll find lots of useful information.

Oh, and even if you use a formula in Excel, get your calculator out to manually check the numbers. I’ve seen too many Excel sheets where the formula didn’t include all necessary cells, throwing the total off.

Not a numbers person? That’s ok. Have someone else look at your budget and ask them to make sure your dollar amounts add up correctly.

7. Show the funder what costs they’re covering – It’s a good idea to show the funder what costs their money will pay for. You can do this by simply adding a column in the expenses. In the example below, the funder can see that the grant being requested will pay for $400 in Materials and Supplies.

Sometimes funders may ask you to be more specific in the narratives about exactly what the grant is paying for. In this case, you can tell them how much of the grant is being used for mulch and how much is being used for plants.

Oh, and it goes without saying, ensure that the costs you’re asking the funder to pay for are allowable. If a funder doesn’t award grants for personnel costs, for instance, don’t ask them for a grant to cover your Program Manager’s salary.

Expenses – Funder Portion

8. Be realistic about the grant amount you’re requesting – Usually, you can find out how much to apply for in a grant application by reading a funder’s guidelines. Maybe there’s a range – ask for no less than $500 but no more than $1,000. Or maybe there’s a specific amount the funder wants to give away.

But what if there’s no recommended amount? How do you know how much to apply for?

We recommend you look at their latest IRS Form 990 and see how much they gave to their grantees in that year. You’ll probably see a trend or you can calculate the average amount. If you have access to Foundation Directory Online, the funder’s profile lists their most common grant amount. Don’t forget, you can always call the foundation and ask them what amount they recommend for a first-time applicant.

In the end, make sure what you’re asking for is reasonable.

The Bottom Line

With millions of grants being submitted every year, you can increase your chances of getting your share by including fully developed grant budgets that tell the story of your grant in numbers.

I could not refrain from commenting. Well written!

I’m not that much of a online reader to be honest but your sites really nice,

keep it up! I’ll go ahead and bookmark your website to come

back later on. Cheers

Hello! I could have sworn I’ve been to your blog before but after

going through some of the posts I realized it’s new to me.

Anyways, I’m certainly pleased I came across it

and I’ll be book-marking it and checking back regularly!

Admiring the time and effort you put into your blog and in depth information you provide.

It’s nice to come across a blog every once in a while that isn’t the same unwanted rehashed

material. Fantastic read! I’ve bookmarked your

site and I’m adding your RSS feeds to my Google account.

Spot on with this write-up, I truly believe

this site needs a great deal more attention. I’ll probably be back again to see

more, thanks for the info!

Very good information!

We need some help with our new non-profit.

Would you please contact us

Thanking you in advance.

Bertron

Bertron, take advantage of all the free resources here on our site. Also join us on Facebook at https://www.facebook.com/groups/FundraisingforFounders/

Greetings! Very useful advice within this post!

It is the little changes that will make the biggest changes.

Thanks a lot for sharing!

Heya i’m for the first time here. I found this board and I

find It truly useful & it helped me out much. I hope

to give something back and help others like you helped me.

Greetings! This is my first visit to your blog! We are a

collection of volunteers and starting a new initiative in a community in the same niche.

Your blog provided us useful information to work on. You have

done a wonderful job!

It’s an amazing piece of writing for all the internet people; they

will get advantage from it I am sure.

Really nice post and well written. Enjoyed reading this.

Thank you so much for taking the time to say that!

Hi getfullyfunded.com webmaster, Your posts are always well-referenced and credible.

Thank you for the feedback. We are so grateful we can be helpful to you.

– Coach Jessie