It’s no secret that effective fundraising fuels your nonprofit’s work—but not all of the donations that may be useful to your nonprofit are necessarily monetary. In-kind donations (i.e., gifts of goods or services) can also benefit your organization in various ways, from providing program supplies to lending professional expertise for projects to helping you secure appealing charity auction items at no cost.

It’s no secret that effective fundraising fuels your nonprofit’s work—but not all of the donations that may be useful to your nonprofit are necessarily monetary. In-kind donations (i.e., gifts of goods or services) can also benefit your organization in various ways, from providing program supplies to lending professional expertise for projects to helping you secure appealing charity auction items at no cost.

If you’ve run an in-kind donation drive before, you’re likely familiar with some of the challenges of soliciting these valuable gifts, such as designating collection sites and creating policies regarding the types of gifts you can and can’t accept. But collecting these contributions is only half the battle—you also need an effective backend process to make the most of them.

In this guide, we’ll review three best practices for reporting and recognizing in-kind donations so your nonprofit can comply with regulations and build stronger supporter relationships. Let’s dive in!

1. Correctly Track In-Kind Donation Values

An in-kind donation is worth its fair market value (FMV), which is the price you would pay if you bought that good or service on the open market. Knowing this amount is important for accurately tracking your nonprofit’s donation revenue in your financial records. However, some in-kind donations are easier to value than others.

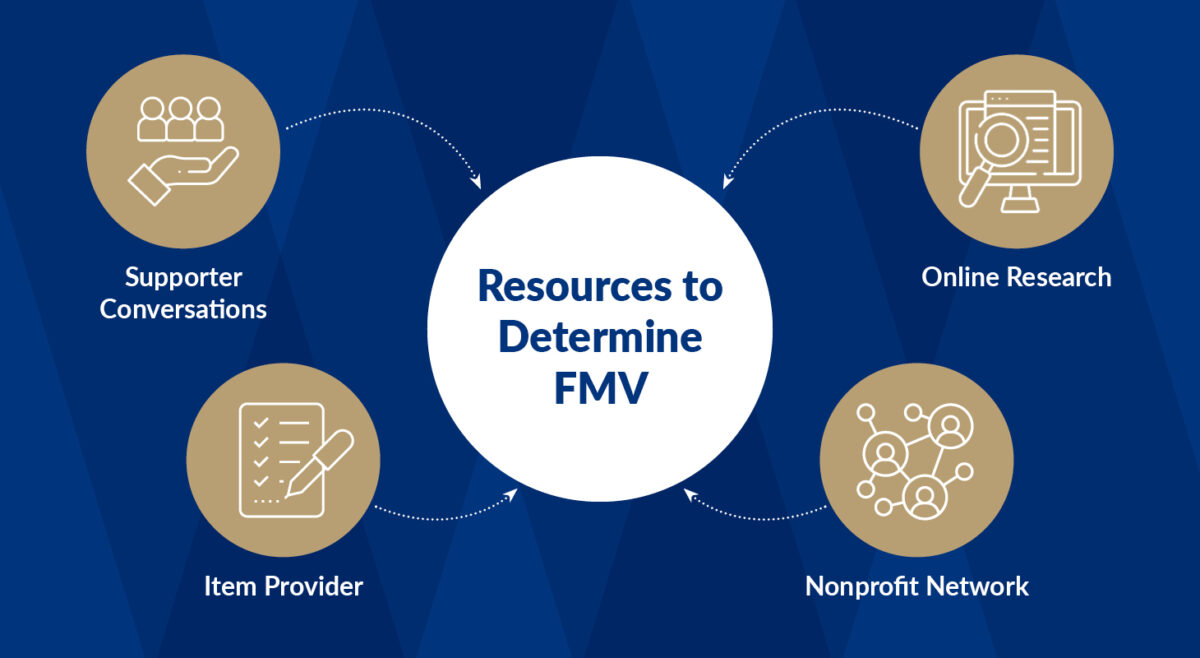

Winspire’s guide to in-kind donations recommends using the following resources to find a gift’s FMV:

- Online research. In many cases, you can look up the price of a donated good or service (or something comparable) online. For example, if someone contributed a new iPad to your nonprofit, the full list price on Apple’s website would be the gift’s FMV. If the item is uncommon, like a piece of antique furniture to feature in your upcoming auction, check eBay or other auction sites to see what similar pieces are selling for.

- Your nonprofit’s network. Consider reaching out to other nonprofits in your area to see if they’ve purchased or received something similar to your in-kind gift, and if so, what they recorded as its FMV. Even if you’ve researched a unique item, asking around can give you a valuable second opinion to further hone your estimate.

- The item’s provider. Especially for donated services, it can also be helpful to talk to the donor about the value of their gift. For instance, if a web developer redesigned your organization’s website for free, you could ask them their going rate for a similar project and estimate how much their gift was worth from there. If you ask a provider about the FMV of a unique good, like signed celebrity memorabilia, take the estimate with a grain of salt because the owners of these items tend to overvalue them.

- Supporter conversations. If you still need more input on the FMV of a donated auction item, ask loyal supporters who might be interested in that prize what they’d be willing to pay for it. Alternatively, you could ask what they’ve paid for similar items at other auctions.

Once you’ve made your best estimate on the FMV of an in-kind donation, add it to your organization’s financial records. As Jitasa’s nonprofit bookkeeping guide explains, in-kind contributions require double-entry tracking, meaning you’ll record the FMV as both a debit and a credit. This is because donated goods and services result in a net zero gain in cash for your organization, despite their value to your mission.

2. Be Transparent About In-Kind Giving

Accurate recordkeeping of in-kind donation values is important for proper reporting, which not only helps your organization comply with nonprofit financial regulations but also allows you to share these gifts’ impact with supporters. Here are a few key places where you’ll need to report on in-kind donations:

- Tax forms. You’ll need to report the FMV (credit value only) of all in-kind donations along with the rest of your nonprofit’s contributed revenue on your annual Form 990. The IRS also requires that you submit extra forms for specific types of in-kind gifts if you’ve received them, including historical artifacts and artwork, vehicles, and other items worth $25,000 or more.

- Donation receipts. Most in-kind donations are tax deductible for donors, so make sure to issue a donation receipt to confirm the write-off. Your nonprofit isn’t legally allowed to provide the value of the gift on these receipts—leave a space for the donor to write it in instead. However, you should include a description of the goods or services contributed and a statement that the donor didn’t receive anything in return for their gift.

- Annual report. While there isn’t a formal procedure for acknowledging in-kind donations in your annual report, you could include the total value of non-cash gifts received throughout the year or the number of commonly donated items among your other fundraising data. For example, an animal shelter could share how many pounds of pet food or cat litter its donors contributed.

By being transparent about how in-kind donations impact your nonprofit’s revenue—and, therefore, its ability to further its mission—you can encourage more individuals and businesses to donate goods and services in the future.

3. Show Appreciation for In-Kind Donors

The importance of showing donors you value them is the same across the board, regardless of whether their gifts were monetary or in-kind. However, there are a few additional considerations for thanking in-kind donors that you should be aware of, including:

- Matching the thank-you to the gift’s value. You may have heard of adapting your appreciation methods based on gift size, and this is also true for in-kind donations based on their FMV. Someone who donated a few cans of food to your food bank might feel aptly appreciated with a simple thank-you email, while a donor who contributed a truck deserves significantly more recognition (such as an annual report mention or social media shoutout).

- Using different appreciation methods for different types of gifts. In some cases, you’ll also need to match your thank-you to the type of in-kind donation. For example, if you receive pro bono graphic design services, credit the designer on the materials they create. Or, for donated auction items, include a line in the prize’s auction catalog entry or on its bid sheet that says something like, “This item was contributed by [Donor Name].”

- Being extra careful with corporate sponsors. The best partnerships between companies and nonprofits are mutually beneficial. Make sure corporate in-kind donors receive free publicity in exchange for their contributions—for instance, a grocery store that donated water bottles and snacks for your 5K fundraiser might have their logo on your event signage and t-shirts. This also goes for nonprofit in-kind donors, such as museums that let other nonprofits use their facilities as event spaces at no cost.

Above all, always personalize your thank-you messages for in-kind donations. Include the donor’s preferred name, specific gift, and how you plan to use it so they know how much you value their support, which will make them more likely to contribute again.

The Bottom Line

As you implement these best practices, assess your progress periodically and see where you can improve your reporting and recognition efforts. Over time, you’ll build stronger relationships with in-kind donors, boost in-kind giving rates, and better understand how these contributions affect your nonprofit’s impact.

About the Author

Jeff Cova worked for more than 20 years in event management, sales, and fundraising before launching an auction production company that provided solutions to many of the challenges he faced in those fields. In 2008, Jeff founded Winspire with the goal of helping nonprofits across North America increase their event fundraising revenue and better engage their donors. Jeff and his team have helped these organizations identify 200,000 new supporters and raise more than $110 million for their missions to date!