The most important thing you must do when you receive a donation of any size is immediately thank your donor warmly and provide a donation receipt.

The most important thing you must do when you receive a donation of any size is immediately thank your donor warmly and provide a donation receipt.

But it can’t be just any boring donation receipt. It needs to have some feeling behind it.

Sadly, so many nonprofits completely miss this opportunity to wow their donors, so it’s actually easy to stand out among the rest by making a few simple improvements.

Let’s take a look at what an awesome donation receipt looks like so you can nail yours!

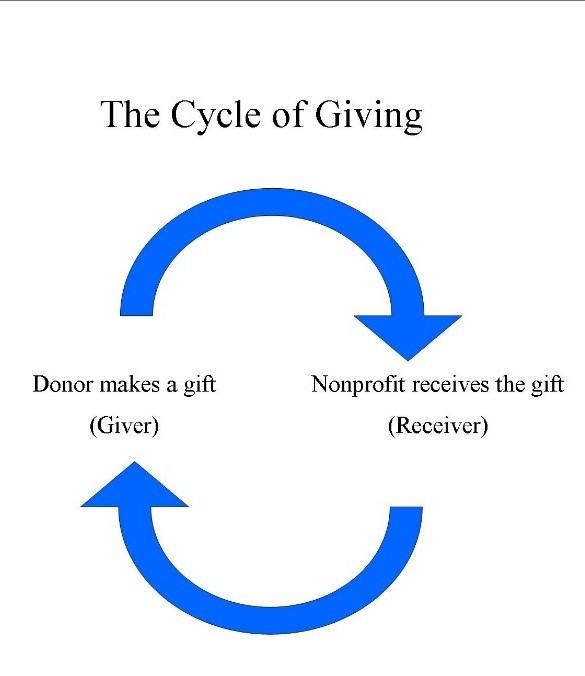

The Cycle of Giving

Your thank you/receipt has a job to do.

It needs to be warm, sincere, and prompt so that it closes the loop on the gift and makes the donor feel great about their giving experience.

We call it the Cycle of Giving, and here’s how it works:

The donor gives a gift.

The nonprofit receives the gift.

The nonprofit sends the donor a receipt, thanking them for choosing to contribute to the cause.

This completes the cycle and sets the stage for your organization to receive another gift from the donor.

By the way, how you thank the donor (i.e. by mail or email) depends on the way they gave.

When you receive a gift by check, print and mail a personalized letter of appreciation that serves as the receipt.

When you receive an online gift, your personalized letter of appreciation (that also serves as the receipt) is sent as an email. This can be automated through your donor management software and needs to be warm and friendly – not generic and bland.

The donation receipt can almost seem like a clerical task, but it’s not. It’s part of building a strong donor relationship.

Given how important the donation receipt is in securing a future gift and inspiring the donor to tell others about your organization, crafting the perfect donation receipt is hardly a clerical task to check off your list.

It’s more like an art form. One that you can learn with practice and by understanding the real purpose of a donation receipt.

Think of your donation receipt as an ambassador, representing your nonprofit in a professional and friendly manner and thanking the donor for their support.

What makes a good ambassador?

- They’re friendly.

- They’re professional.

- They build trust.

- They’re helpful.

Your donation receipt should be all these things: friendly, professional, engendering trust, helpful.

Unfortunately, donation receipts are often dull, jargony, full of default text, and off-brand. Many donation receipts do nothing to capture the heart of the organization and why its work matters.

I got a stiff, impersonal donation receipt recently and, as I looked at it, I just thought, “What the heck?”

What I would have preferred to feel was some kind of positive emotion, like they appreciated me.

By taking an ambassador approach to writing your donation receipts, you can make donors smile – rather than shrug – as they store the receipt in a folder for tax records.

You can inspire donors to want to give to your organization again and again.

Why You Need a Fresh, Engaging Online Donation Receipt

Your online donation processing tool probably offers a generic receipt full of standard text.

Many people use that since it’s already there.

Big mistake.

It might provide the necessary receipt information, but it simply isn’t warm enough to meet the donor’s emotional needs.

There are no words of appreciation in the generic receipt.

There’s no passion.

There’s no reason to give again.

And there may not even be anything that identifies your nonprofit as the sender.

Receiving this type of generic receipt leaves me cold. It makes me wonder if I gave my gift to the right organization.

And trust me, you don’t want your donors thinking this way!

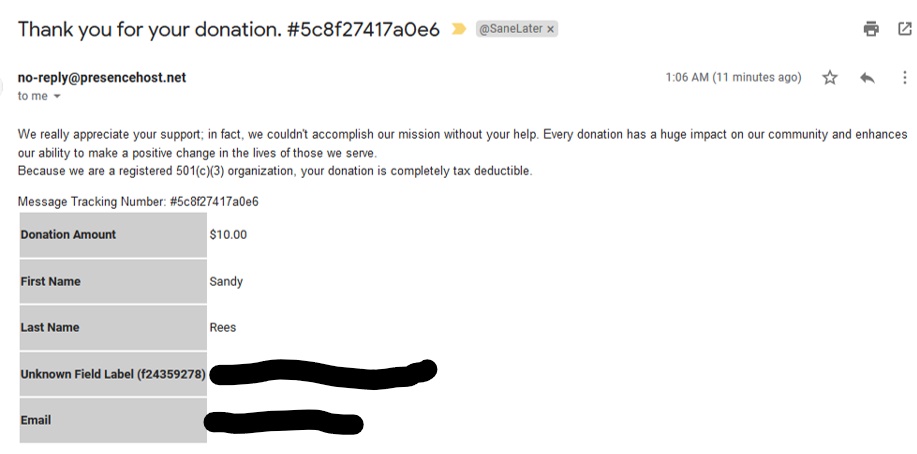

I’m not sure what’s worse with the example above: the receipt number in the subject line, the “no-reply@” email, or the fact that the nonprofit didn’t even bother to identify themselves in the email. What a huge missed opportunity to connect with the donor!

At least they made an attempt to soften the thank-you message some, but it could’ve been way more personal.

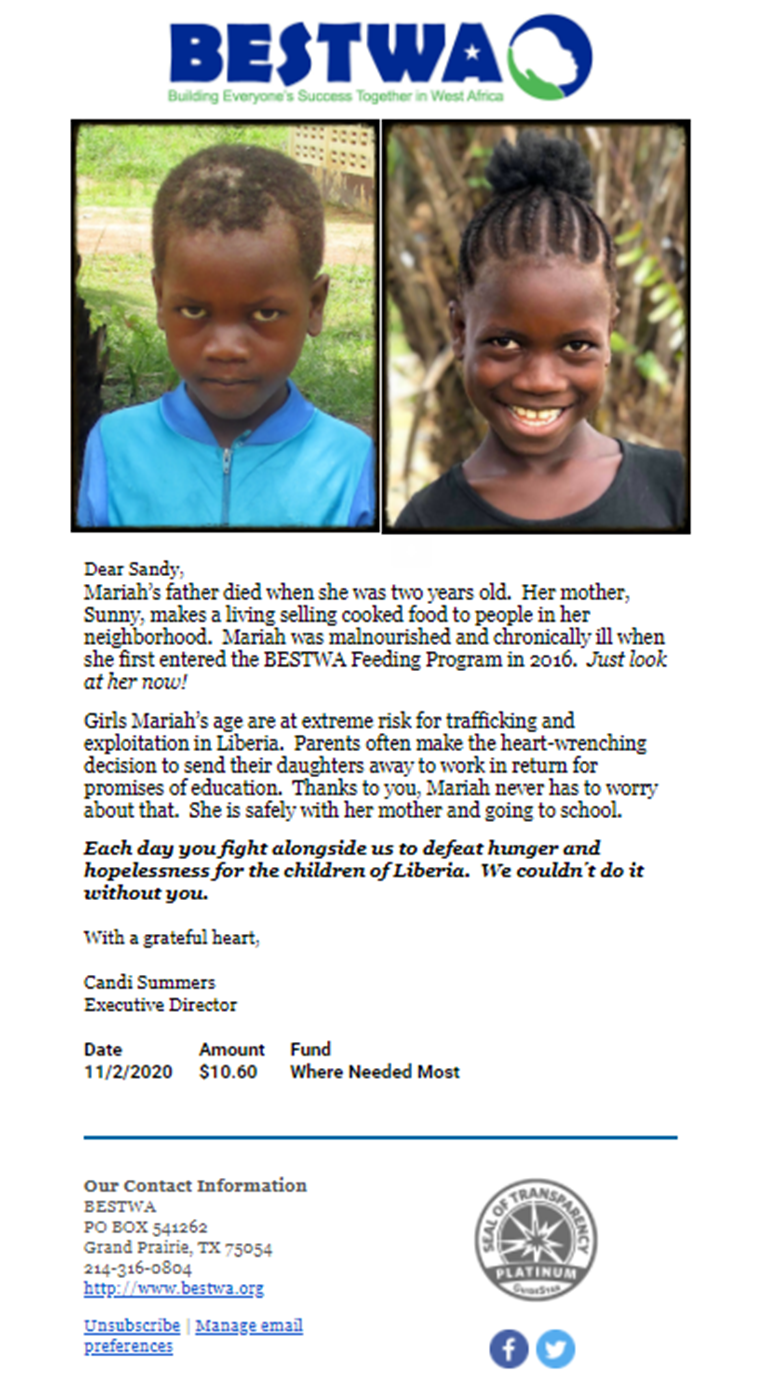

Now, here’s a really good donation receipt. It filled me with warmth and happiness when I received it!

It’s not hard to see the difference, is it?

The first one is cold and screams “tax receipt!”

The second one exudes hope. In face, it makes ME want to give to this nonprofit all over again every time I look at it!

A well-written receipt is not just about a tax record. It’s about making the donor feel amazing.

You want your donor to think, “I did that! I made that gift! I was part of this success story!”

A well-written receipt gives the donor a reason to feel great, which strengthens the relationship.

Here are a few more reasons why taking the time to write an effective donation receipt will pay off:

- First impressions are everything. When you send a prompt, well-written, emotionally moving, and informative receipt, you demonstrate to the donor that you’re a well-organized nonprofit that values professionalism. For first-time donors, you want to impress upon them that you value their gift and plan to put it to good use right away. By doing so, they have a higher likelihood of giving again.

- The donor knows you received their gift. In the donor’s mind, they can’t close the loop on the gift until they receive a receipt. But when they receive a receipt that is no different than the one they get when they purchase a box of cat treats, it makes their gift feel transactional rather than meaningful.

- You make it easier for the donor at tax time. Everyone wants their tax preparation to go smoothly. By providing a donation with the date, amount, organization name, and tax identification number clearly identifiable, you make the donor’s life easier.

The Winning Formula for a Flawless Donation Receipt

As important as it is to create the best kind of online donation receipt, it’s an art form you can master through practice and by following our formula.

So here are the components of a flawless donation receipt you should have in yours:

Now, let’s look at a few examples of online donation receipts that put these components into action.

Example #1

Subject: You really are a hero!

Dear Ellen,

Your gift could not have come at a better time to guarantee a seat in our program to a deserving student!

You answered our call for donations so students could move off our waiting list and into classrooms. Because of your gift, and gifts from other generous donors like you, 7 new students got to enroll in school!

These 7 children are receiving a quality education, 3 meals a day, mentoring, and medical care. And your gift made it happen.

In Haiti, a typical adult has just 5 years of schooling, and the literacy rate is only 53%. Because of you, a Haitian child has a brighter future and the opportunity to break the cycle of poverty.

Thank you for your gift of $50 on March 5, 2024 to the Haitian Children’s Education Network as part of our annual Back to School Campaign.

Our tax ID number is 11-1111111. No goods or services were given in exchange for this donation.

Warmly,

Jane Smith

Executive Director

Example #2

Subject: Here’s how we used your gift!

Dear Samantha,

Wow! You really came through when families needed you!

Your donation arrived just when a record number of your Whitfield neighbors were seeking help with food.

We used your gift to buy more rice, pasta, canned goods, and other staples, which our guests were able to take home to their pantries.

Making sure everyone in our community has enough to eat has never been harder. Did you know one in five Whitfield children experiences food insecurity at least once a month?

Heroes like you make sure families have a place to go where they can request the food items they need and know they will be treated with dignity.

Thank you a hundred times over for your gift of $100 on March 5, 2024 to the Whitfield Food Pantry.

Our Tax ID Number is 11-1111111. No goods or services were given in exchange for this gift.

Warmly,

Jane Smith

Executive Director

Example #3

Subject: Wow! What a gift!

Dear Mark,

We were blown away to receive such a generous donation from you!

As a small organization, a gift this size goes a long way.

We used it immediately to immunize and provide heartworm prevention to 10 dogs.

Thanks to you, these dogs will be protected as they wait to be adopted and go to their forever homes.

Dogs with a history of heartworms have a very hard time getting chosen for adoption, and treatment for heartworms is difficult and uncomfortable.

You are a hero for making sure these dogs will not have to suffer!

Thank you for your gift of $500 (Wow!) on March 5, 2024 to Paws Whitfield.

Our Tax ID Number is 11-1111111. No goods or services were given in exchange for this gift.

Warmly,

Jane Smith

Executive Director

The Bottom Line

Put as much thought into your donation receipt as you put into an appeal for money.

An appeal will get you a gift right now, and a thoughtful, personal donation receipt will get you the next gift in the future.

We all like to feel good.

We know that thanking people for their acts of kindness makes them feel good.

So why not pour it on for your donors? It’s not false praise!

Donors really ARE heroes that make it possible for organizations to change lives.

Additional resources

Online Donation Thank-You/Receipt Template: https://getfullyfunded.com/wp-content/uploads/2019/03/Online-Donation-Thank-You-Receipt-Template.pdf

Who is the email from? Use a real person’s name, typically your Executive Director or the person in charge of acknowledging gifts.

Who is the email from? Use a real person’s name, typically your Executive Director or the person in charge of acknowledging gifts. Hero language. When you tell a donor that your nonprofit wouldn’t exist without them, you’re speaking truth. So why be shy about saying it?

Hero language. When you tell a donor that your nonprofit wouldn’t exist without them, you’re speaking truth. So why be shy about saying it?

Leave A Comment