To fully fund your nonprofit, you need a diversified fundraising stream.

To fully fund your nonprofit, you need a diversified fundraising stream.

In other words, you need to get your money from many different sources – not just one awesome foundation, one government grant, or one generous donor.

Diversified fundraising revenue creates stability and keeps you from being dependent on one source of funding.

If you get all your money from a single, wonderful donor, what happens when that donor turns their attention—and their dollars—elsewhere?

If you rely solely on a government grant, what happens when the agency changes its eligibility criteria and you no longer qualify?

If you depend on a foundation with whom you have a long-standing relationship, what happens when the grants manager—your primary contact—retires and the Trustees decide to support another cause?

Getting your funds from multiple sources is especially important when fundraising for a new nonprofit. In developing different revenue streams, you’re building a solid foundation that’ll ensure your nonprofit’s growth and success for many years.

A Cautionary Tale

A few years ago, I worked with a client that had received almost all the funding for their $1M budget from a single grant through the State of Tennessee.

Cue the sad music.

The State went through budget cuts, which happens all the time, and reduced its grant funding – rendering this organization ineligible under new guidelines.

The impact on the nonprofit was swift and harsh.

They went from thriving… to struggling big time.

Unfortunately, the nonprofit’s leaders had failed to prepare for ANY other revenue.

No earned income from programs.

No fundraising from individuals.

No private foundation grants.

Nothing.

Even though the organization had been around for three decades, they had never asked anyone for a donation.

We got them on a path to fully funding their budget using our proven strategies, but it was too little too late. Time was not on their side, and it was heartbreaking.

Moral of the story? Don’t put all your eggs in one fundraising basket!

Don’t rely on single source funding because you never know when it might vanish.

The Flip Side: A Success Story

What happens when you have a diversified funding stream for a nonprofit?

What happens when you have a diversified funding stream for a nonprofit?

In short, you have something to fall back on.

I remember when I was working at the food bank, and a major event happened: 9/11.

Folks across the U.S. and around the globe stepped up to express their support by sending donations to organizations providing services to people impacted by 9/11.

It was certainly a life-changing moment, and the response was profound and amazing.

Lots of us working in fundraising started to get nervous, though.

Would our donors give to New York and not us?

How much would we be short?

What would we do to make up the difference?

I watched my numbers very carefully that year and was thrilled when all my best donors sent in their gifts.

I remember ONE corporate donor who didn’t make their usual $10,000 gift to us and instead directed their charitable giving to New York.

But that was totally fine.

Since I had money coming in from so many sources, the loss of that single large gift wasn’t detrimental.

I had several healthy streams of revenue, including a strong monthly giving program and a large base of individual donors.

I’d built relationships with foundations and had grants coming in.

I was going to be just fine.

Unfortunately, some of my colleagues were left flailing and begging for last-minute support in the wake of 9/11 because their funding streams were not diverse enough.

It’s normal to feel pangs of fear every time a big event happens – hurricanes, earthquakes, war, global humanitarian crises – taking away some of your donors’ attention.

But if you have diverse income streams, your nonprofit will remain strong, even when your cause is not getting a lot of attention.

What Does Good Diversified Fundraising Look Like?

In a nutshell, no more than 25% or so of your organizational income should come from a single source.

This means you have a mix of different donors, like online giving, major gifts, monthly donations, events, corporate contributions, grants, and so on.

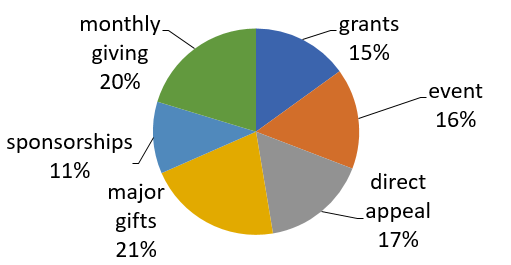

Here’s an example of a nonprofit that has good diversified fundraising:

In this example, money’s coming in from lots of different sources, and no single source (or slice) dominates the pie.

This is a healthy situation!

If you lose a donor from one slice, you can make up the income from another slice.

So if your outdoor event gets rained out, you can increase revenue from another source or spread it out across a few sources.

See how that works?

Now, every organization may not have all these fundraising streams and everyone’s pie will look different.

But every organization needs to have several distinct sources of income (or several slices of pie).

Just be sure you’re slicing your pie in a way that makes sense for your organization.

Give this exercise a try! Make a pie chart of your funding sources.

I like Excel for creating pie charts because it’s super easy to use.

How many slices of pie do you have?

Is one slice gobbling up more than 1/4 of the pie?

If so, you need to build up your other funding sources or maybe even create new ones.

Perhaps now would be a good time to try out a monthly giving program if you haven’t started one yet.

The Right Combination of Pie (well, revenue)

I don’t know about you, but all this talk about pie is making me hungry!

Now that you know what your pie looks like, you can think about how to add more slices and increase or decrease some of the slices you have.

It can be confusing to figure out where to start. I get it.

That’s why I recommend the 1-10-1,000 Rule.

The 1-10-1000 Rule gives you a simple structure to guide your fundraising activities for the year and encourages you to focus on 3 streams of revenue:

- 1 signature event

- 10 grant opportunities

- 1,000 individual donors.

Signature Event: Make your signature event great and put your heart into it!

Rally together a strong committee of all-stars who can help you plan and pull it off.

Network to secure as many corporate sponsorships as possible.

Create an experience that everyone loves and wants to come back to year after year.

Ultimately, you’ll want to get a substantial return on your investment of time, money, and effort (so don’t let it become a runaway train that drains your organization of its resources and energy with nothing to show for it).

Grants: Get 10 grants. Or more!

Do your research to find flaming hot opportunities and create a deadline calendar so you know what to apply for and when.

It’s tempting to apply for everything you can find or to ALL the local foundations in your area, but that’s not an effective strategy.

You’ll expend more energy than you’ll recoup in funding. Trust me!

Instead, apply only for grants that align beautifully with the work your nonprofit does.

Individual Donors: Grow your donor base to 1,000 individuals.

Long-term fundraising success hinges on the size and loyalty of your donor base.

So, focus on building it.

Work at it constantly.

Surround your nonprofit with a large pool of supporters who WANT to see you succeed.

The more you have, the safer it is for you in the long run because if you lose one donor, you still have 999 more.

Getting to 1,000 may sound intimidating, but there are tons of strategies to find new donors, like:

- Mail appeals

- Email asks

- Social media

- Media coverage

- A table at community events

- Speaking engagements at churches and community groups

- Small gatherings at homes hosted by a Board member

When building up your individual donor base, always be thinking about new places you can go to find a lot of prospective donors.

I call this fishing where the fish are!

For instance, if you notice several new donors coming to you from a particular church, see if you can set up a speaking engagement to a Bible study at that church.

Look for opportunities. They’re everywhere!

Example of Revenue Stream for a Small Nonprofit

Circling back now to pie charts and numbers, here’s an example table of revenue for a small nonprofit, broken down by percent of the overall fundraising pie.

| Revenue stream | Description | Projected dollars raised | Percent of total |

|---|---|---|---|

| Grants | Private foundation grants | $15,000 | 15% |

| Event | Fundraising gala | $31,500 | 32% |

| Individual donors | Feb: Valentine’s appeal

April: Spring appeal September: Fall appeal December: Year-end appeal |

$2,500

$5,000 $10,000 $5,000 |

3%

5% 10% 5% |

| Giving Tuesday | Invite people to give online and via email | $5,000 | 5% |

| Monthly Giving | Invite people to commit to a monthly donation | $5,000 | 5% |

| Program Sponsorship | Sponsor the costs of part of the program at $1,200 each | $18,000 | 18% |

| Marketing | Give at least 12 presentations in the community (civic groups, clubs, etc.) | $1,800 | 2% |

| Total | $98,800 |

But there’s a red flag 🚩in this example. Do you see it?

The event is expected to bring in 32% of the organization’s annual revenue. That’s too high for my comfort level!

What if something happened and the event was canceled?

That’s almost 1/3 of the organization’s income GONE.

The good news is, you have other sources to turn to for help.

Using these estimates, I’d also recommend beefing up monthly giving.

In my experience, direct, heartfelt communications to your regular donors can yield a big response to monthly giving, especially if there is a matching gift opportunity, such as a donor willing to give $100 for every new monthly donor.

Plus, monthly gifts mean predictable income, and this is better for the sustainability of your nonprofit.

What else could you do – boost grant funding to 20%?

Perhaps, but it’ll require more time invested in finding the right grant opportunities (and time spent applying and then waiting on decisions).

Is there a way to squeeze more out of speaking engagements?

With only $150 expected at each of the 12 speaking engagements, the return on time investment is low.

That said, if you want to bolster this source of revenue, aim for speaking opportunities where interest is already likely to be high.

How about activating fundraising ambassadors?

A good fundraising ambassador is someone who is bursting with enthusiasm and can’t wait to tell everyone they know how great your organization is.

With a little coaching, they might even inspire others to give!

Imagine if you had 8 ambassadors each raising $250 from their friends, families, and colleagues. That’s $2,000! Might be worth it, right?

By boosting monthly donors, grant funding, and revenue from speaking engagements and seeking the help of your ambassadors, that over-reliance on the annual fundraising event will be reduced, and the organization will be more stable.

Also, the organization will bring in more money to fund more programs! Make sense?

The Bottom Line

If you’ve never looked at your revenue in terms of streams, and calculated each stream as a percentage of the total (like the sample), I encourage you to do that.

If you’ve never looked at your revenue in terms of streams, and calculated each stream as a percentage of the total (like the sample), I encourage you to do that.

It’s very eye-opening.

You may find that you’re a little too dependent on one source, and you can do something about it before it becomes a problem.

Once you choose the diversified fundraising strategies you want to use for the year, work to master them.

This whole concept of diversified fundraising revenue streams doesn’t feel good if you’re struggling and nothing seems to work.

If you’re starting from scratch, take it one piece (or slice!) at a time.

Remember, Rome wasn’t built in a day, and if you have lots of streams to build, it’ll take time.

Start with the 1-10-1000 Rule and plan your one event, get your grant calendar together, and then start building your donor base.

Be proactive in creating diversified fundraising streams.

Create a plan and work it.

Get organized.

And stay committed.

Also, be sure to monitor your diversified fundraising revenue streams each month to see how they’re doing.

You can’t manage what you don’t measure, and you’ll want to manage this.

Watching the numbers is half the fun! …and so is pie.

Excellent, informative article. I love the 1-10-1000 rule. Thank you.

How do you build up revenue stream when you are NEW? How do you convince individuals or companies when you have no track record? How do you “convince” them you will do the right thing?

Thomas Moran.

It can seem tricky to inspire people to give when you haven’t started programs yet. So, what you have to do is inspire them with your plans. Talk about what you’re going to do and why it matters. Talk about the need and how you’ll address it.